Navigating the Dynamics of Dow Jones E-Mini Futures: A Comprehensive Analysis

The Dow Jones E-Mini Futures market has become an integral component of global financial landscapes, offering investors a unique avenue to engage with the fluctuations of the Dow Jones Index in a more dynamic and accessible manner. In this article, we delve into the intricacies of Dow Jones E-Mini Futures, exploring the key concepts, live updates, and the broader impact on financial markets.

Understanding Dow Jones E-Mini Futures:

Dow Jones E-Mini Futures represent a smaller-sized version of the standard Dow Jones Industrial Average (DJIA) futures contract. These contracts provide traders with an opportunity to speculate on the future movements of the Dow Jones Index without having to trade the larger, more capital-intensive standard contracts. The “E-Mini” designation denotes the electronically traded nature of these futures, making them more accessible to a broader range of investors.

The Dow Jones Index: A Brief Overview

Before delving into the dynamics of Dow Jones E-Mini Futures, it’s crucial to understand the Dow Jones Index itself. The Dow Jones Industrial Average, commonly referred to as the Dow, is a price-weighted index that tracks the performance of 30 large, publicly-owned companies listed on the New York Stock Exchange (NYSE) and the NASDAQ. These companies span various sectors, offering a snapshot of the overall health of the U.S. stock market.

Dow Jones Live: Real-Time Market Insights

For investors and traders seeking up-to-the-minute information on market trends, Dow Jones Live has become an invaluable resource. Real-time updates on the Dow Jones Index provide a continuous stream of data, allowing market participants to make informed decisions based on the latest developments. Whether it’s breaking news, economic indicators, or geopolitical events, Dow Jones Live keeps investors in the loop, enabling them to react promptly to changing market conditions.

Navigating the Index: Dow Jones E-Mini Futures in Action

Dow Jones E-Mini Futures play a pivotal role in the portfolios of institutional and individual investors alike. The smaller contract size allows for greater flexibility, making it an attractive option for those looking to manage risk exposure and allocate capital more efficiently. Traders can go long (buy) or short (sell) Dow Jones E-Mini Futures contracts, depending on their market outlook.

Risk Management: Hedging with Dow Jones E-Mini Futures

One of the primary applications of Dow Jones E-Mini Futures is risk management. Investors often use these contracts to hedge against adverse market movements, providing a level of protection for their broader portfolios. By taking a position in the opposite direction of their existing investments, market participants can offset potential losses and maintain a more balanced risk profile.

Market Liquidity and Accessibility:

The electronic nature of Dow Jones E-Mini Futures contributes to the overall liquidity of the market. Electronic trading platforms facilitate swift execution of trades, ensuring that investors can enter and exit positions efficiently. This accessibility has democratized futures trading, allowing a more diverse range of market participants to engage in Dow Jones-related strategies.

Market Influences on Dow Jones E-Mini Futures:

Several factors influence the movements of Dow Jones E-Mini Futures, mirroring the broader influences on the stock market. Economic indicators, corporate earnings reports, geopolitical events, and monetary policy decisions all play a role in shaping market sentiment and, consequently, the value of Dow Jones E-Mini Futures contracts.

Global Impact: Dow Jones Index as a Barometer

The Dow Jones Index is often regarded as a barometer of global economic health. As a result, fluctuations in Dow Jones E-Mini Futures can have a ripple effect on international markets. Investors worldwide closely monitor these movements, recognizing the interconnectedness of the global financial system.

Market Sentiment and Dow Jones E-Mini Futures:

Understanding market sentiment is crucial when navigating Dow Jones E-Mini Futures. Sentiment analysis involves assessing the collective mood of market participants based on various indicators, including news sentiment, social media trends, and options market activity. Traders often use this information to gauge potential market reversals or trends, enhancing their decision-making process.

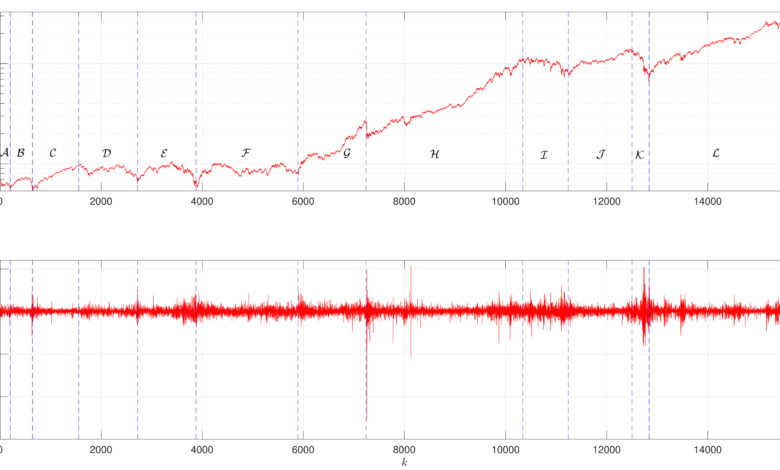

Technical Analysis: Charting Dow Jones E-Mini Futures

Technical analysis is a key tool for traders engaging in Dow Jones E-Mini Futures. Price charts, trendlines, and technical indicators provide valuable insights into potential entry and exit points. Whether using moving averages, stochastic oscillators, or support and resistance levels, technical analysis helps traders make sense of historical price data to inform their future trading decisions.

Conclusion:

In conclusion, Dow Jones E-Mini Futures offer a dynamic and accessible way for investors to engage with the movements of the Dow Jones Index. Understanding the intricacies of these futures contracts, along with the broader influences on the Dow Jones Index, empowers market participants to make informed decisions. Whether for speculation, risk management, or portfolio diversification, Dow Jones E-Mini Futures have become an integral component of the modern financial landscape. As global markets continue to evolve, staying informed and adaptable is paramount for success in navigating the complexities of Dow Jones E-Mini Futures.